In every country, including the UK, there are local laws and criteria for determining the tax residence and tax base. In the UK, despite the introduction of changes intended to facilitate tax residence procedures, many people do not even know when they become tax residents. Therefore, they do not know how to optimize taxes and take advantage of the extensive system of numerous social benefits. In the text below, I will show you how to suss out the British system and plan your move to the UK properly.

Poles on the British Isles

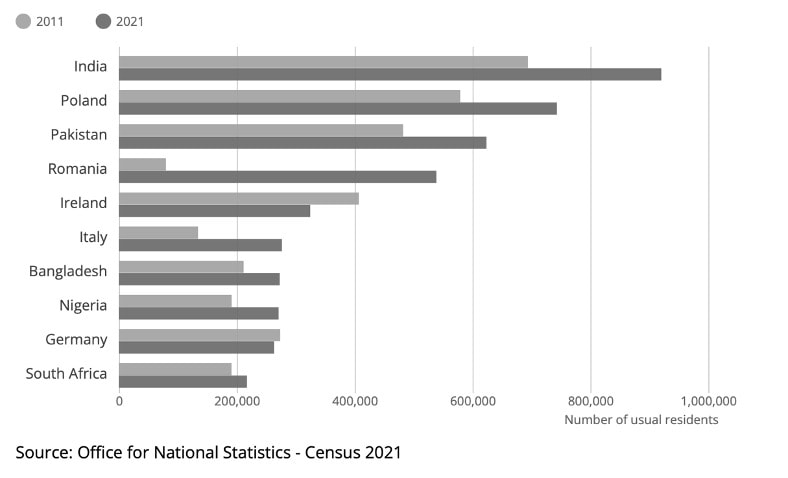

There are still hundreds of thousands of Poles in the UK. Poles are the second national group, after the Hindu in terms of population of the Isles. The 2021 census[1] showed that in England and Wales there live 743,000 people born in Poland. By comparison, there are 920,000 India-born people on the British Isles, accounting for 1.5 per cent of the population.

Chart 1. Top 10 countries of birth outside the United Kingdom whose citizens live in England and Wales. Comparison of 2021 to 2011.

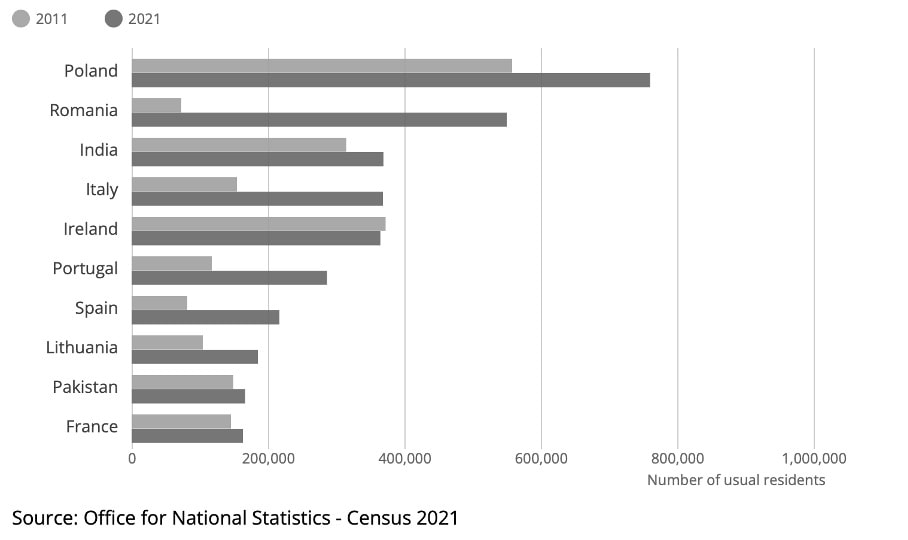

There are 760,000 people with Polish citizenship and the Polish passport is still the most common non-UK passport held in England and Wales.

Chart 2. The Polish passport remains the most widely held non-UK passport in England and Wales – the chart shows the top 10 non-UK passports in 2021, compared to 2011 figures.

Despite the fact that Poles still constitute such a large group, the number of foreigners moving to the UK, including Poles, decreased with Brexit. This is undoubtedly related to the change in the rules of emigration to the UK. As of 1 January 2021, the rules on the free movement of people no longer apply, which means that moving to the UK is subject to many conditions. And it is often difficult for Polish citizens to find their way through the applicable regulations. This comes as no surprise, as in most countries these are 3-4 conditions, quite simple to meet, while in the UK, it is a whole catalogue of rules, and the cost of legal advice in the UK is prohibitive. Therefore, many Poles living in the UK come to us for advice. Regardless of the obstacles, they want to settle on the Isles. They choose this place to do business, guided by the fact that the British economy is stable and the legal system predictable. The UK is also a large market on its own and provides a good basis for further expansion. In addition, it offers benefits and incentives for tax residents.

So how do you become a tax resident in the UK?

In the UK, the tax year is different and runs from April 6 to April 5 of the following year, and, if it were not enough, the conditions for tax residence in the UK are different than in most countries of Europe, so comparing them with each other is quite fiddly. Imagine a person who has not reported a change of tax residence and suddenly reports to two tax offices of different countries and it is necessary to present appropriate arguments and compare the conditions of the two systems. You will see below that this is not an easy task. So let us take a closer look at how to determine if you are a tax resident in the UK.

Statutory test of tax residence in the United Kingdom

The first thing anyone who has just moved to or already lives in the UK needs to do is establish their tax residence status. In 2013, HM Revenue & Customs introduced a special Statutory Residence Test (SRT), which consists of three main parts and a series of simple questions. By answering these questions you will be able to understand whether you are/were a UK tax resident in any tax year. The tests work in such a way that meeting the first one does not require anyone to move on to the next one.

- Automatic overseas tests

- First, you may be recognised as a UK tax non-resident if you were a UK tax resident for one or more of the previous three tax years and, in addition, you spent less than 16 days in the UK in a given tax year.

- Secondly, you could be considered a UK tax non-resident if you were not a UK tax resident in any of the three tax years preceding the tax year and, at the same time, spent less than 46 days in the UK in that year.

- Finally, you may be recognised as a UK tax non-resident if you worked full-time outside the UK in a given tax year and spent less than 91 days in the UK in a given year, and the number of days on which you worked for at least 3 hours in the UK was lower than 31 and there was no significant break from working outside the UK.

- Automatic UK tests

- First, a person will be recognised as a UK tax resident if they spent at least 183 days in the UK in a given tax year.

- Second, a person will be a UK tax resident if they had a home in the UK for the entire tax year and the home was available to them in the UK for at least 91 days in a given tax year, and at least 30 of those 91 days were used by the person during their stay in the UK. Over the same period of time, such a person did not have a home in other countries outside the UK, and if they had such a home, they stayed in it for less than 30 days in a given tax year.

- Third, you may be considered a UK tax resident if you worked in the UK full-time for 365 days in a tax year, with more than 75% of the time during those 365 days including days of more than 3 working hours in the UK, at least one day must fall both within 365 days and within a tax year and include more than 3 working hours in the UK.

- Sufficient ties test

- Based on this test, it is verified whether a person holds tax residence in the UK based on the number of aspects which tie them with the UK, i.e.:

- family tie (i.e. the immediate family lives in the UK),

- accommodation tie (i.e. having a place of residence in the UK for at least 91 days),

- work tie (i.e. at least 40 days of work in the UK),

- a “90 day” tie (i.e. staying in the UK for 90 days during any of the last 2 tax years),

- country tie (i.e. more time spent in the UK than in another country)

- Based on this test, it is verified whether a person holds tax residence in the UK based on the number of aspects which tie them with the UK, i.e.:

Depending on the length of time spent in the UK, a different number of tests is required to determine UK tax residence. If a person was a UK tax resident in at least 1 tax year out of the 3 years before the one under consideration, then the following numbers of ties are required:

- if 16-45 days were spent in the UK: at least 4 ties,

- if 46-90 days were spent in the UK: at least 3 ties,

- if 91-120 days were spent in the UK: at least 2 ties,

- if more than 120 days were spent in the UK: at least 1 tie.

However, if a person was not a tax resident in the UK in any of the 3 tax years before the one under consideration, the following numbers of ties are required (the country tie tests is not applied):

- if 46-90 days were spent in the UK: at least all 4 ties

- if 91-120 days were spent in the UK: at least 2 ties,

- if more than 120 days were spent in the UK: at least 2 ties.

Completing the test (SRT) enables you to understand your residence status in the UK for tax purposes. However, it is important to remember that each tax year should be viewed separately, so the tests should be applied to each year independently. If you are a resident in the UK for tax purposes, the initial position is such that you are a tax resident for the entire tax year in which you arrived. Once you have established that, you need to check further tests. At that point, you will find out whether you are a resident for the entire tax year in which you moved in, or whether you are able to divide the year into two parts in which you are a resident only from the day you arrived in England.

So you are a UK tax resident, what comes next?

If you are classified as a tax resident based on your test results, you will be subject to the same rules as any other UK tax resident. You are a tax resident for the entire year from April 6 to April 5 of the following year and you have to declare all your income received during this period. This means that you have to declare and pay tax on all your international income regardless of the country and source when submitting a tax return.

Do you always become a UK resident when living or working in London?

The British legal system is highly rational and logical. For example: the system allows for explaining in a logical way that a person who is domiciled and employed in London cannot be a tax resident in the UK because their ties to Poland are stronger.

Obviously, it should be assumed that when you move to the UK to settle there permanently, you are likely to become a resident for tax purposes from the date of your arrival, not from the beginning of the tax year. Then, you can benefit from additional opportunities provided by the tax system. All non-domiciles, i.e. those who were not born in the UK, can choose to be taxed on a remittance basis i.e.: be taxed only on the income received in the UK or the income brought to the UK.

If you are a tax resident in the UK but are not domiciled there. This means that only foreign income and profits which are spent or earned in the UK will be taxed. The income which is earned abroad and remains abroad will not be taxed in the UK. The remittance basis must be requested every year in the annual tax return.

This is not the end of the intricacies of the UK tax residence system

In the UK, your immigration status and tax residence are not directly related and must be considered separately. Your immigration status is your right to enter, live and work in the country depending on your visa or citizenship. Your tax residence must be taken into account when you arrive in the country on any type of visa.

The most difficult part, however, is to skilfully determine the tax residence between the two countries. Across entire Europe, the criterion for days spent in a given tax year is determined within the calendar year. Since in the UK the period from April 5 to April 4 of the following year is taken into consideration, it may happen that you are a resident in two countries in the same year based on the same time spent. Additionally, the UK does not always allow you to make use of the split year. In such intricate situations, it helps to have a well-constructed defence file indicating links to the particular country where we lived. It is very important to prepare it well.

Moving to the UK – immigration issues – key facts

In order to move to the UK, you must obtain a work visa according to the new points system. After 5 years of residence, you can apply for the settled status. A passport is required to cross the border. Note that the tax year in the UK is different from the Polish one, which often causes many complications and it is April 6 to April 5 of the following year (sic!).

There are many things to keep in mind when determining your residence status in the UK for tax purposes. Proper tax planning must cover all aspects of your move to the UK. To avoid surprises and unnecessarily large tax costs, it is worth getting expert advice in this area. And if you take into consideration that at present the taxes you pay in Poland are potentially the lowest in Europe, make it crystal clear that you actually hold British tax residence as you might still be able to settle your taxes in Poland.

[1] International migration, England and Wales, Census 2021, Office for National Statistics – https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/internationalmigration/bulletins/internationalmigrationenglandandwales/census2021