Let’s face it, each portfolio is currently undergoing quick remodelling and regrouping of its assets. The market analysis either prompts caution as in “let’s wait and put planned investments on hold”, or, quite the opposite, encourages a more aggressive approach with focus on potential benefits of a market shakeup and spotting opportunities in stocks that are tumbling most.

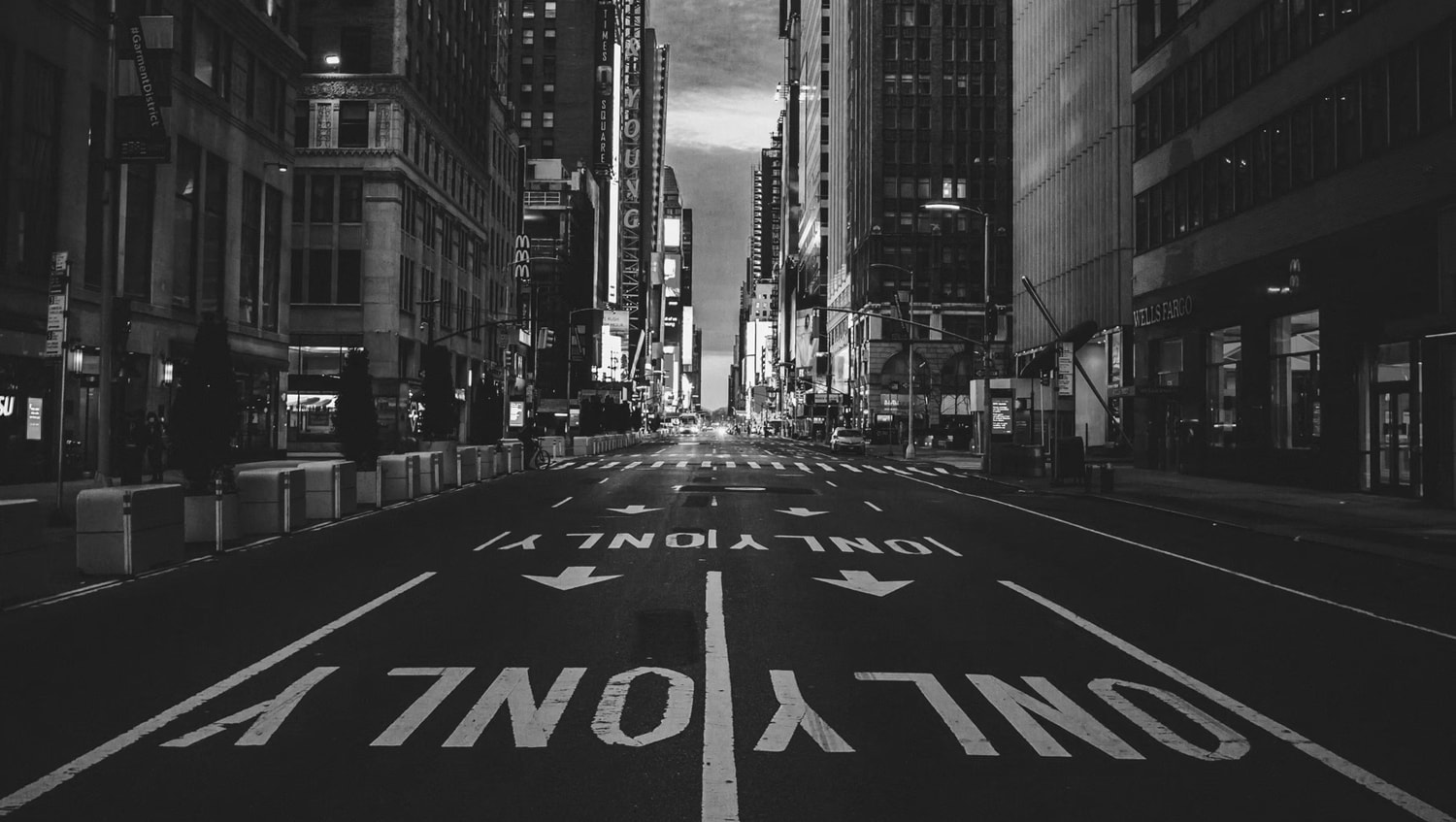

Such dilemmas are global. It does not matter whether the capital comes from Warsaw, New York or Dubai. Investors seek opportunities in this unusual turn of events.

What strategy should Polish companies adopt under such circumstances? Foreign capital (for instance from across the Atlantic) is looking for opportunities in Europe, including Poland. That said, with local regulatory framework being different from what foreign investors know , it is easier for such investors to reach for familiar solutions. In other words, it makes more sense for them to invest considerable capital in a company with a registered seat in the state of New York than in a Polish firm. In practical terms, it will be easier for a Polish company looking for an investor to find them on the American market if its subsidiary or parent company already operates in the US. At this point, we could discuss the security of such investment or proceed directly to the implementation phase. If foreign capital needs such security, we could try to identify the instruments which will ensure it…

How to set up a company in the US?

Meeting all the requirements specified in the majority of business scenarios, C-corporation is by all means the most common way to set up a business in New York, although an LLC has has emerged as a serious contender over the recent years.

C -corporation

C-corporation is the oldest and most commonly considered type of company. First of all, a major advantage of this type of firm is that its owners have limited liability towards obligations arising from the company’s business activity. Consequently, C-corporation seems a natural choice for entities seeking investors.

Double taxation of a C -corporation

Since a C -corporation is a separate legal entity from its owners, it is taxed separately, just as a limited liability company in Poland. It is generally taxed at both the state and federal level. Distribution of income among the company’s owners is subject to a separate personal income tax. In that sense, C-corporation could be seen as inferior to an LLC, which allows for more choice when it comes to the form of taxation. I will get back to it shortly.

Laws governing C-corporations

Unlike an LLC, corporations in the USA (whether it is a C-corporation or an S-corporation) are governed similarly to a limited liability company specified in the Commercial Companies Code (KSH) or a German GmbH in the LLCA.

For example, New York has it own state regulations, i.e. New York Business Corporations Law (BCL)describing such company’s structure. C-corporation must always have a board of directors, as well as other mandatory bodies. Irrespective of the number of shareholders (one or more), the structure of a C-corporation will be the same. In the case of a single-person company, its shareholder can be at the same time a board member (director), secretary and treasurer, simply because the existence of such bodies is required by the company’s Articles of Association and the law. On top of that, shareholder meetings are mandatory in such companies, just as they are in a Polish limited liability company.

C-Corporation has been successfully used to attract investors, whether those listed on the stock exchange or private ones. It is worth noting that formalistic regulations governing a C-corporation are perfect for this purpose. Therefore, entrepreneurs seeking external investors should give a corporation some serious thought, especially when compared to an alternative option which is an LLC.

This type of a company also works well for businesses planning multiple funding rounds (e.g. venture funds etc.).

S- Corporation

Another US corporation, an S-Corporation is treated for tax purposes as transparent. Unlike other states, the state of New York allows for an indirect formation of an S-Corporation. After a C-corporation has been formed, a revocable “Subchapter S Election” must be filed to the IRS and the state tax authorities for a C-corporation to become an S-Corporation. Briefly, an S-corporation is not a separate type of a company, being in fact a C-corporation that opted for a different tax regime.

Sadly, this type of company is not available to associates who are not US residents. Also, the number of its shareholders cannot exceed 100, nor can it issue various classes of shares. Again, an LLC scores higher in this area.

Non-For-Profit Corporation

A nonprofit company, also referred to as Not-For-Profit Corporation, is an entity formed for non-commercial purposes. Unlike a typical company, a not-for-profit firm does not have shareholders (instead, it has members), and its income cannot be paid out or used to the members’ or directors’ benefit, or to the benefit of members of its remaining structures (except for their wages). Not-For-Profit Corporation is similar to a Polish foundation, the difference being that it takes the form of a company. It must have at least three management board members. Please note that the Polish legal system enables a limited liability company to operate for non-commercial purposes, while still allowing for payouts to the board and shareholders.

Limited Liability Company

A Limited Liability Company (LLC) is a C-corporation’s younger sibling. It has been in existence for only 35 years, yet it managed to monopolise the American market to some extent, with many entities opting for this form of setting up their business. Why?

It is worth noting that this type of company can be governed by slightly different laws depending on the state. In the state of New York, it acquires three attractive attributes.

LLC’s Hybrid Form

LLC is considered a hybrid company as it combines liability protection for its members and management board with its status of a fiscally transparent entity (owners are taxed at their personal tax rates).

LLC’s flexibility makes it a very attractive option for entrepreneurs as it allows for doing business with the benefit of limited liability protection (only the company is liable with its assets), with owners taxed at a flat rate. It is a very desirable mix, comparable to a hybrid between Polish limited liability company (sp. z o.o.) and limited partnership. LLC has the same, albeit simplified structure. Its registration in the US costs only twice as much as incorporation of Sp. z o.o. and limited partnerhip in Poland, while being definitely cheaper than forming a simple German limited liability company (i.e. GmbH) in Berlin or Zurich.

What makes for LLC’s unquestionable asset is that the tax laws governing its operation allow the company to pay taxes, while income (or loss) is allocated to its shareholders. This means that if a shareholder has income from other sources, they can utilize LLC’s losses in their tax return. Speaking of taxes, personal income tax in the US is rather high, yet it is payable only in specified cases.

Operating agreement offers flexibility in defining LCC’s operational rules

This is where it gets really interesting. While the state of New York sets out some fundamental rules for LCC’s forming, funding, managing and closing, it gives its founders some leeway to form their own operational rules. They must be laid down in the company’s operating agreement. Concluded between the LCC’s founders and the company itself, the LCC’s operating agreement details company management (management board, internal managers, members/founders, etc.), rights and responsibilities of the founders, taxation method (sic!), rules of convening shareholder meetings, quorum requirements and, finally, the methods of income/loss allocation to members etc.

Tax classification for an LLC is selected upon the company’s formation

One of LCC’s most surprising properties is that it offers the possibility of choosing the corporate income taxation method. When the company is formed, its founders decide whether LCC will be treated for tax purposes as transparent or as a corporation. Immediately after the company’s registration in New York, the firm will be requested to provide relevant information in a special form. In this location, taxing members at their personal tax rates is the most commonly selected option.

What is the best business structure to set up in the US?

Each case is unique and requires an individual analysis. Aside from purely business-related matters, legal and tax strategy must be carefully reviewed.

For instance, criteria applied to a company set up to run business operations in the US (e.g. a firm designed to provide Machine Learning services to local corporations) will no longer be relevant if we are dealing with a holding company.

In the latter case, C-corporation seems a better option not just for corporate reasons, but also from the taxation point of view. C-corporation benefits from considerable tax exemptions and tax deductions, which can effectively reduce its tax liabilities to zero. That said, each case is different and requires an in-depth analysis reflecting the company’s business plan.

For Polish entrepreneurs, setting up the right type of company on the US market could open up new avenues to cooperation with global trading partners. It can also help them attract investors with sizeable capital. While these prospects seem extremely tempting, this can be a path full of traps. Competent advisors well up on modern and dynamic business structures can offer reliable advice on what type of business structure will work best in a particular scenario, as well as provide services in the scope of transborder relations with investors.